QuickBooks Payroll FAQ

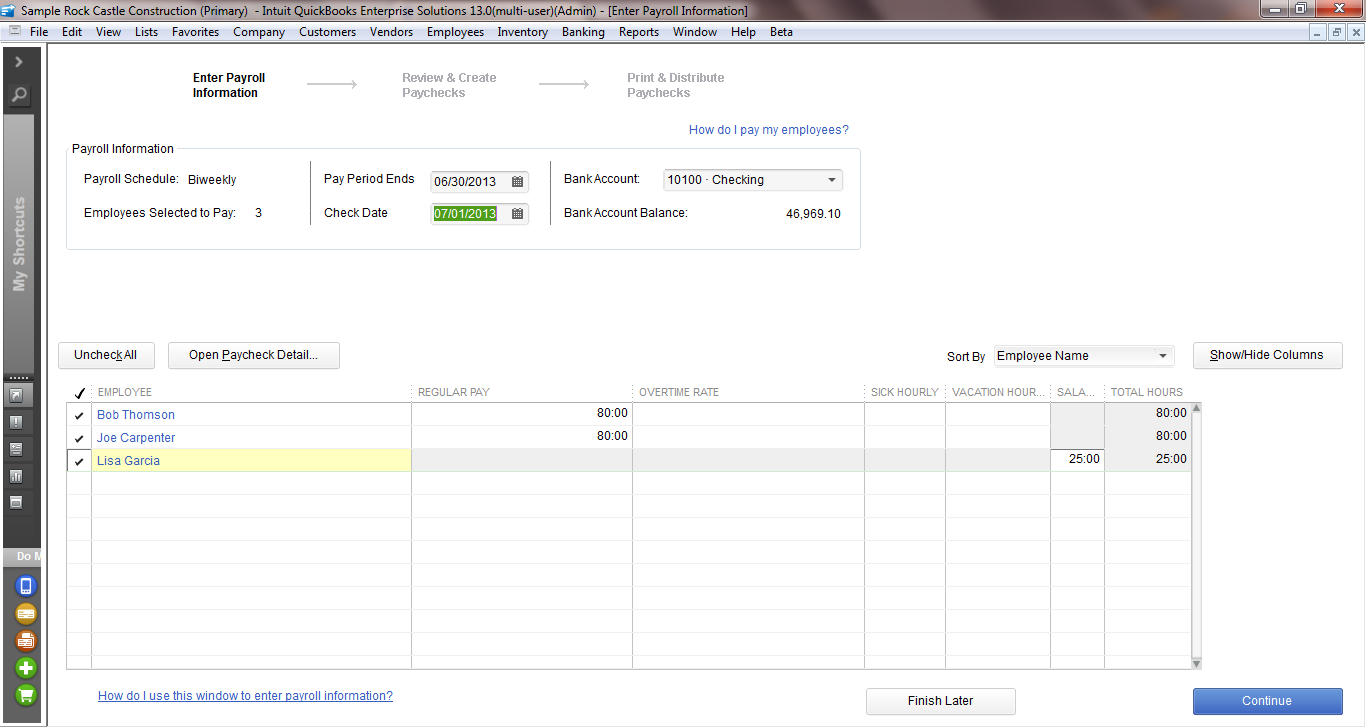

What is QuickBooks Payroll Basic?

QuickBooks Payroll Basic provides essential payroll processing features, including paycheck calculation and direct deposit, but does not include tax filing services.

What is the difference between QuickBooks Payroll Enhanced and QuickBooks Payroll Basic?

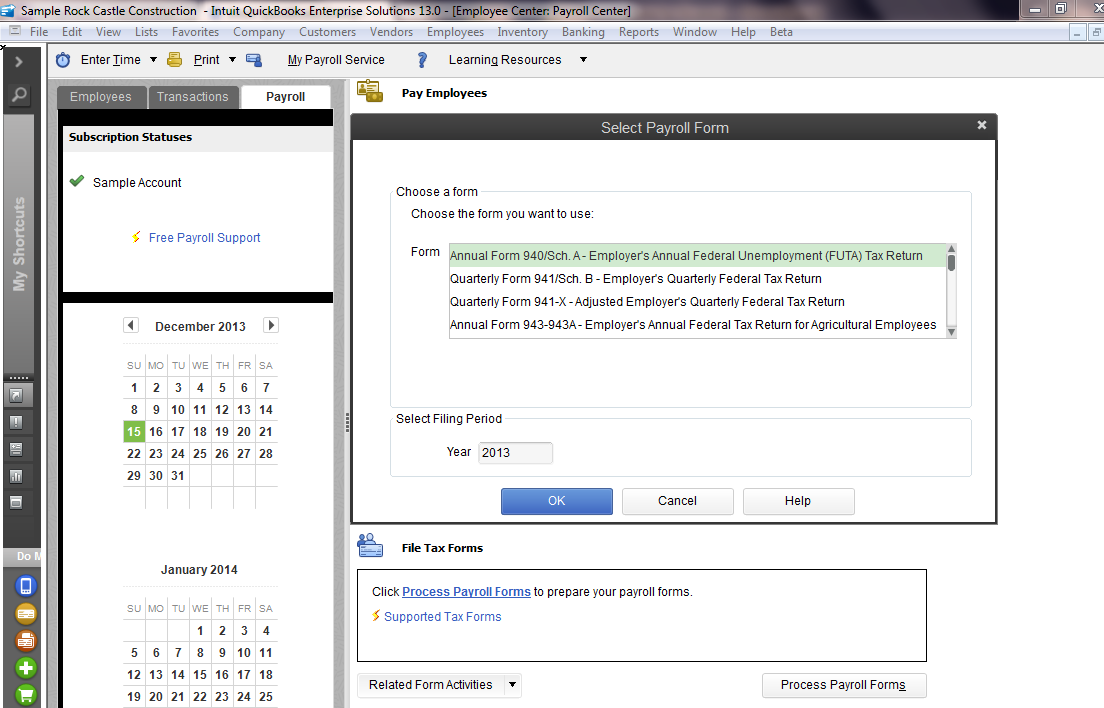

QuickBooks Payroll Enhanced features include automated tax calculations and form preparation, whereas Basic only handles payroll processing.

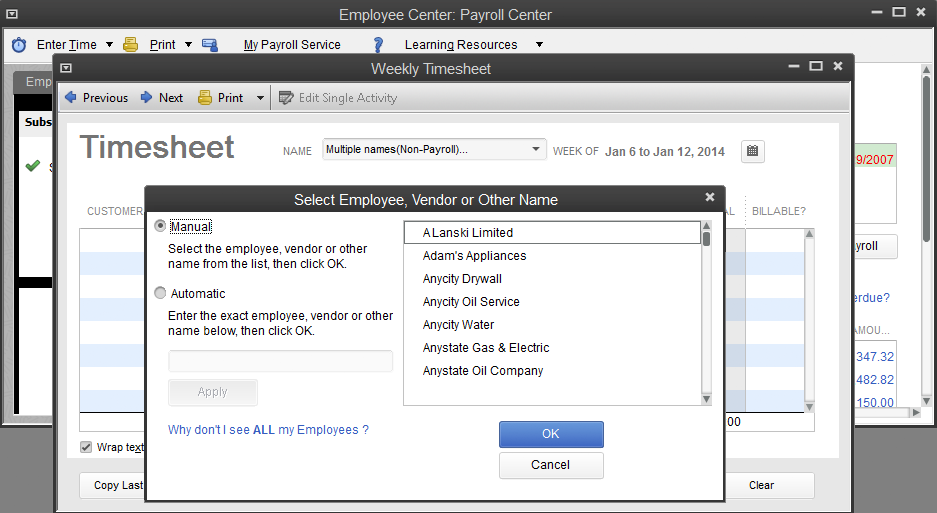

Can QuickBooks Payroll handle contractor payments?

Yes, QuickBooks Payroll allows you to pay both employees and independent contractors.

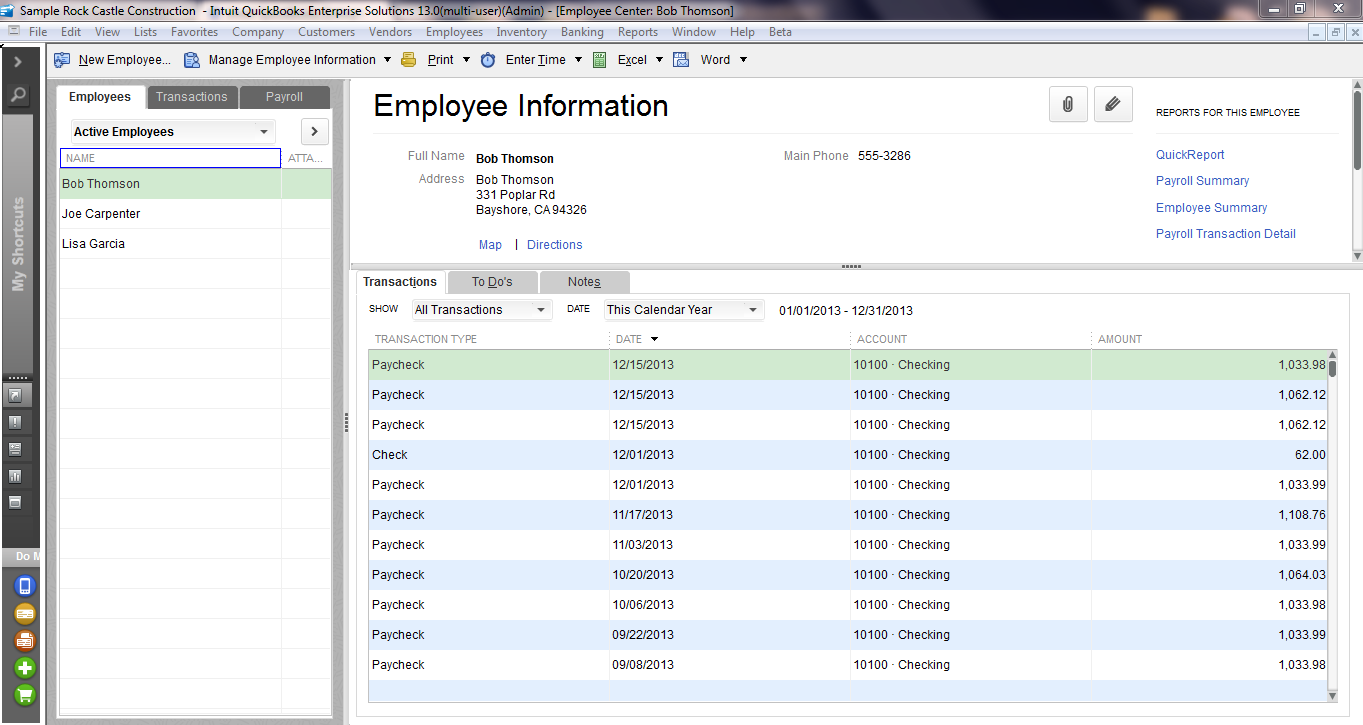

Is QuickBooks Payroll available for both QuickBooks Online and QuickBooks Desktop?

Yes, QuickBooks Payroll is available in different plans for both QuickBooks Online and QuickBooks Desktop users.