QuickBooks Enterprise for Nonprofit Organizations

Simplify Your Accounting, Save Time, Achieve More, Impact Greater

QuickBooks Enterprise for Nonprofit Organizations provides advanced tools to manage donations, track budgets from anywhere with cloud access, and generate insightful reports.

QuickBooks Enterprise for Nonprofit Organizations is tailored to meet the unique financial and operational needs of nonprofits. It simplifies fund tracking, enhances financial transparency, and helps organizations focus on achieving their mission.

Empowering Nonprofits with Advanced Accounting Tools

QuickBooks Enterprise for Nonprofits is designed to address the unique challenges of managing donations, grants, and budgets. It simplifies financial processes with tools that track funds, ensure compliance, and provide real-time insights. Whether you're managing campaigns or allocating resources, this powerful solution helps nonprofits stay focused on their mission while improving efficiency and transparency.

QuickBooks Enterprise Key Features

for Nonprofit Organizations

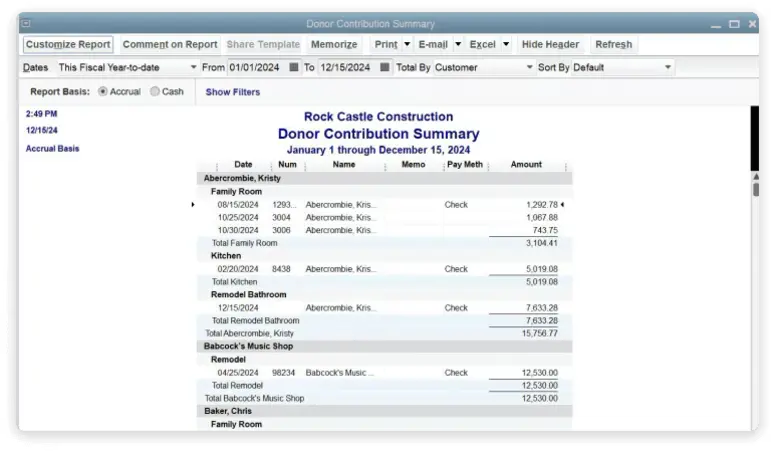

Nonprofit-specific report bundles

Enterprise includes 9 reports created specifically to provide the information nonprofits need. In addition, Advanced Reporting* allows you to create your own custom reports from scratch using the raw data in QuickBooks. If the data is in QuickBooks, you can report on it to gain a deeper understanding of your organization.

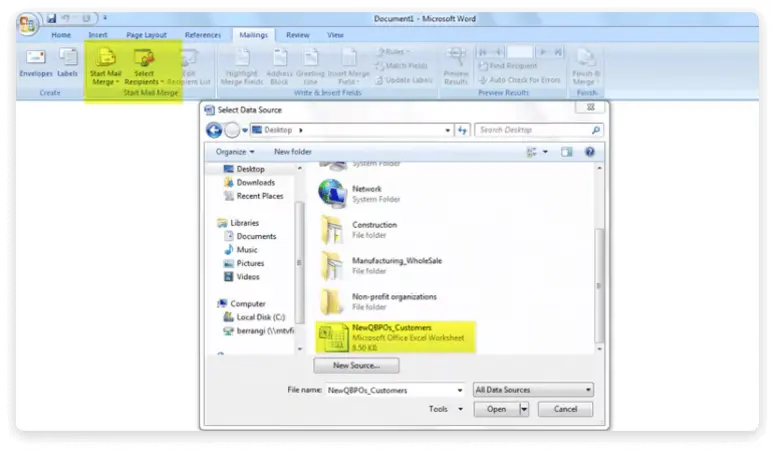

Microsoft® integration

Use prepared letters made with Microsoft® Word templates; QuickBooks pre-populates the letters with your data, so no retyping is required.

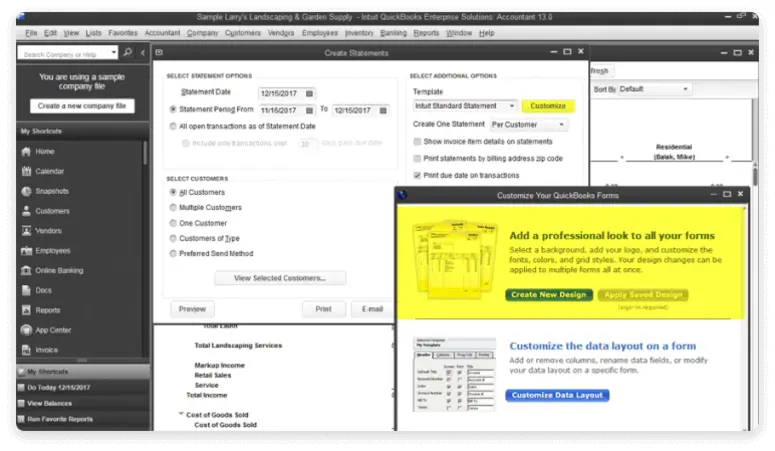

Template customization options

Using built-in templates, format reports and donor forms the way you want. You can customize fields and add your logo and mission statement.

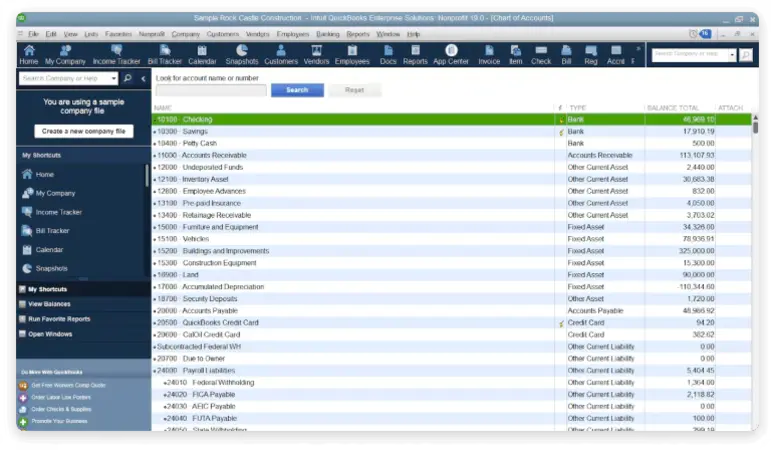

Nonprofit chart of accounts

The nonprofit chart of accounts categorizes your financial activity into different accounts and subaccounts, including assets you own like bank accounts, investments, property, and equipment; revenue from donations or sales; expenses for programs, utilities, salaries, and more. It also incorporates the unified chart of accounts, so you can easily and reliably transfer data directly into IRS forms.

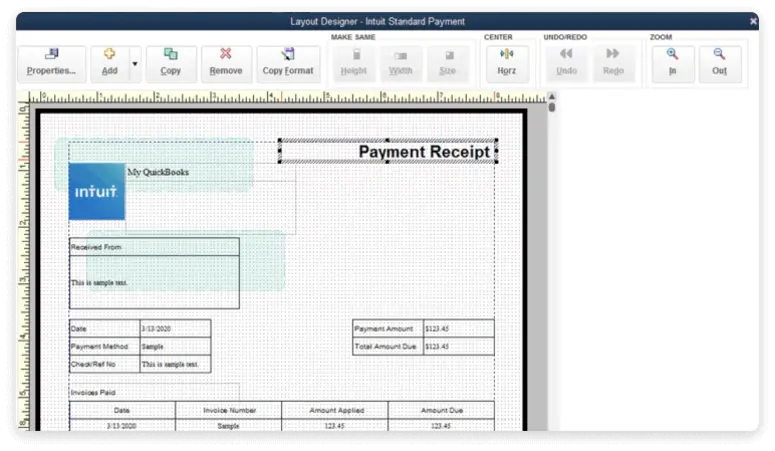

Customize payment receipts

Customize payment receipt formatting, including logos, for a professional and consistent look across your donor communications.

One home for all of your donor data

Enterprise easily connects with your favorite apps* so all your data is in the same place. You can integrate with more than 200 apps, including those made for nonprofits like Method:Donor, DonorsFix, and much more.

*Apps sold separately, additional fees may apply.Bill and PO workflow approvals

Manage cash flow and boost transparency with bill and purchase order workflow approvals that create a digital audit trail for each transaction. Oversee cash flow and track bills for approval from one dashboard. Customize your workflow approvals your way, or use out-of-the-box templates to make it easy to set up approval flows that cater to your business.

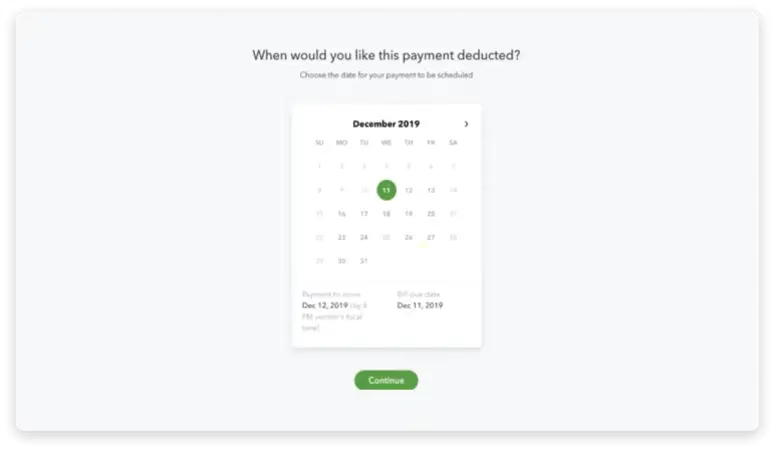

Schedule and pay bills faster with QuickBooks

Save time by scheduling and paying bills in QuickBooks. Use the funding source you choose and a digital or physical form your vendors prefer. QuickBooks automatically marks the bill paid and notifies you once the money is sent. Gain financial flexibility by paying vendors from a card or bank transfer, then having the money sent via physical check or bank transfer.

Key Reports to Help Schedule and Run Your Nonprofit Business

Unlock the power of key reports to streamline scheduling and operations for your nonprofit. Discover insights that drive efficiency, track progress, and help achieve your mission goals.

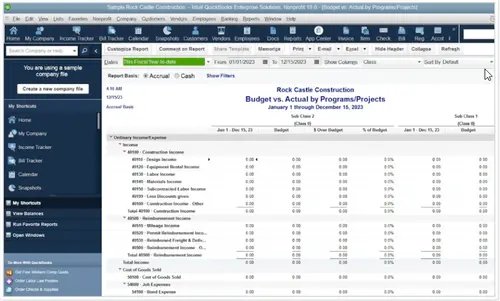

Budget by Programs

Budget by Programs for Non-Profit Organizations helps you compare specific budget items to actuals for each program or project, ensuring accurate financial tracking and management. This allows you to track performance and allocate resources effectively. Stay on top of your nonprofit's financial goals with detailed, actionable insights.

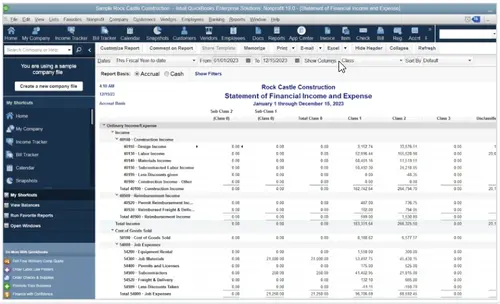

Statement of Financial Income & Expense

The Statement of Financial Income & Expense for Non-Profit Organizations provides a clear breakdown of your financial activity. Easily see how much money came in and how it was spent, helping you track revenue and expenses. Gain valuable insights to manage your nonprofit’s financial health effectively.

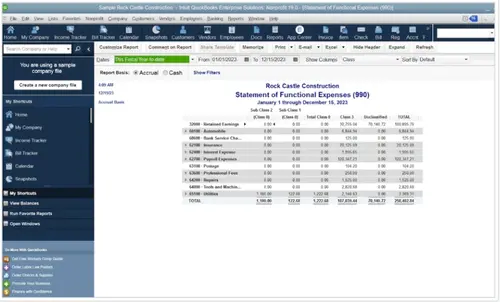

Statement of Functional Expenses - 990

The Statement of Functional Expenses - 990 for Non-Profit Organizations simplifies expense tracking for IRS compliance. Easily identify and categorize expenses required for reporting on IRS Form 990. Stay organized and ensure accurate financial documentation for your nonprofit.

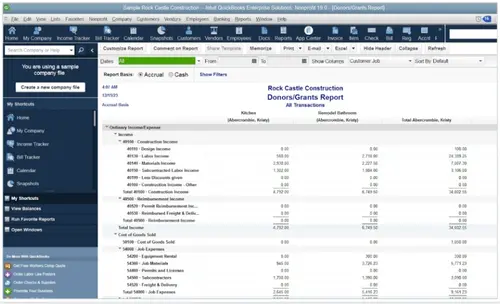

Donors & Grants

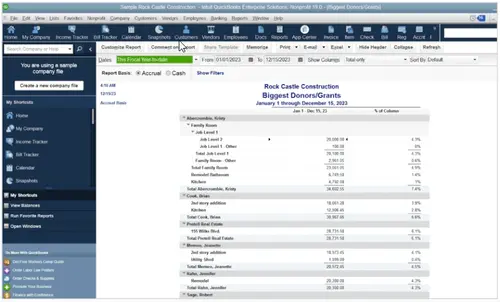

The Donors & Grants report for Non-Profit Organizations provides a detailed view of contributions. Easily track donations by each donor or grant, giving you insights to manage funding effectively. Strengthen your nonprofit’s financial oversight and donor relationships with this comprehensive report.

Biggest Donors

The Biggest Donors report for Non-Profit Organizations helps you stay connected with your key supporters. Track your largest donors and grants in one convenient report, ensuring you recognize contributions and build stronger relationships. Keep your funding efforts organized and impactful.

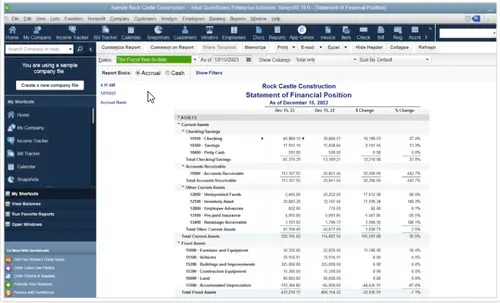

Statement of Financial Position

The Statement of Financial Position for Non-Profit Organizations offers a clear snapshot of your financial health. Easily view your balance sheet today and compare it to last year to track changes over time. Gain valuable insights to support strategic decision-making for your nonprofit’s future.

Why QuickBooks Enterprise is Best for Nonprofit Organizations

Here we highlight some key benefits of QuickBooks Enterprise for nonprofit organizations that go beyond standard accounting features. These advantages make it a powerful solution for managing funds, enhancing donor relationships, and ensuring compliance, helping nonprofits achieve their mission with greater efficiency and transparency.

Streamlined Fund Management

QuickBooks Enterprise enables nonprofits to track donations, grants, and other funding sources efficiently. It provides clear visibility into fund allocation, ensuring that every dollar supports your mission.

Enhanced Donor Tracking

Manage donor information with ease, including contributions, contact details, and engagement history. Build stronger relationships with donors through personalized interactions and transparent reporting.

Comprehensive Reporting Tools

Access industry-specific reports, such as donor contribution summaries and expense allocations. QuickBooks Enterprise helps nonprofits showcase financial accountability to stakeholders and auditors.

Budget Planning and Monitoring

Create and monitor budgets for programs, campaigns, or organizational needs. Stay on top of spending and ensure resources are utilized effectively to achieve your goals.

Compliance with Nonprofit Standards

QuickBooks Enterprise supports compliance with nonprofit accounting standards like FASB and GAAP. Generate required financial statements and reports with ease.

Payroll and Volunteer Management

Simplify payroll for employees and track volunteer hours for specific programs. Stay compliant with nonprofit payroll regulations and improve workforce efficiency.

Cloud Access for Remote Work

Access financial data securely from anywhere with QuickBooks Enterprise cloud hosting options. This feature is ideal for nonprofits with remote teams or multiple locations.

Scalable for Growing Nonprofits

QuickBooks Enterprise grows with your organization, offering flexibility for expanding programs or increasing donor bases. Choose the edition that fits your current needs and upgrade as you grow.

Seamless Integration with Nonprofit Tools

Integrate QuickBooks Enterprise with donor management systems, fundraising platforms, and other nonprofit-specific tools. Streamline operations and enhance overall productivity.

QuickBooks Enterprise for Nonprofit Businesses is the ultimate financial solution for organizations aiming to streamline operations, manage funds efficiently, and focus on their mission. With powerful tools and industry-specific features, it empowers nonprofits to build trust, achieve goals, and make a lasting impact.

Get Started with Minding My Books

- Expert Consultation: Reach out to Minding My Books for expert guidance in setting up QuickBooks Enterprise for your construction business.

- Training and Support: We provide comprehensive training and ongoing support to ensure you're maximizing the software’s capabilities.

- Tailored Solutions: Our team will help configure QuickBooks Enterprise to fit your specific construction and contractor needs, ensuring streamlined operations and profitability.